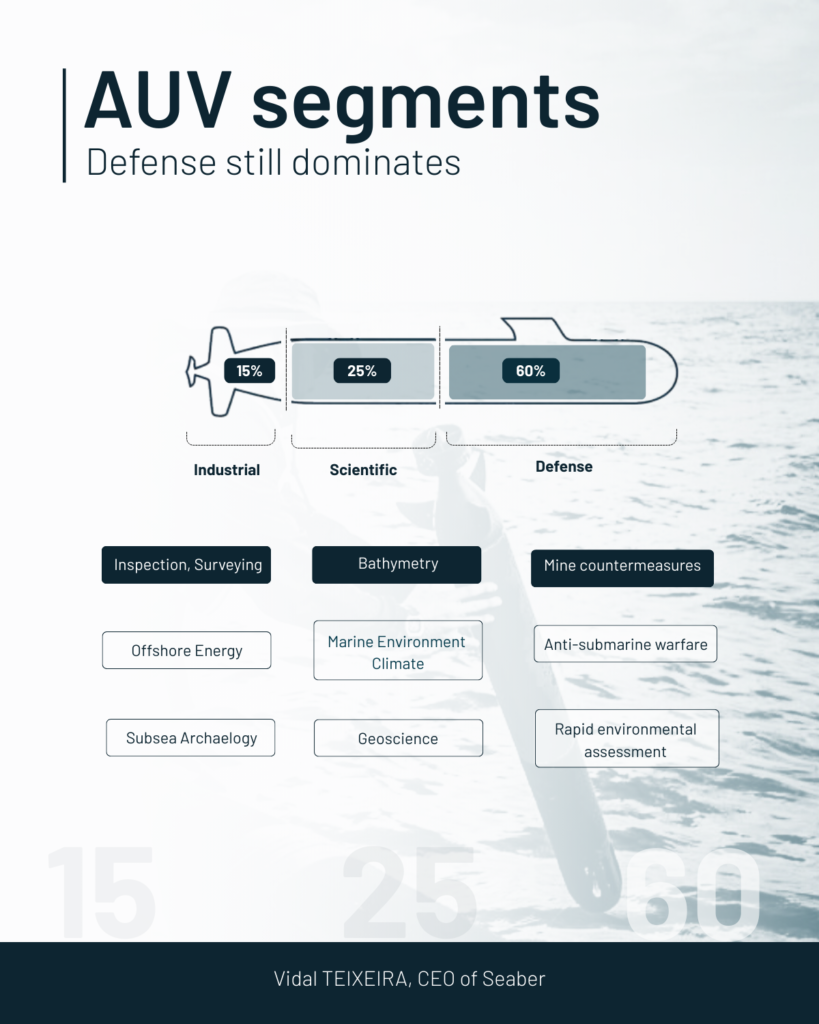

AUV segments : Defense still dominates

How the AUV market seems to be structured, and why MCM dominates

Observations from the underwater domain

Scope note: This post does not aim to cover all AUV applications or sensor types. Excluding very large AUVs, the segments below reflect where operational adoption and market volume are currently concentrated.

The AUV market is shaped primarily by mission maturity, procurement reality, and substitution effects, rather than by technology alone.

From my perspective, a realistic structure today is:

~60% Defense & maritime security

~25% Scientific & oceanographic applications

~15% Industrial offshore energy & inspection

Within defense, Mine Countermeasures (MCM) clearly stand out. MCM is not only the largest AUV segment today, but also the one that has evolved the most. Over the past decade, it has shifted from manned minehunters and towed sonars to distributed unmanned architectures, with AUVs at the core of seabed survey, detection, and classification. This transition is now embedded in doctrine and fleet-level programs across multiple navies.

This evolution is reflected in major national programs:

France: SLAM-F

United Kingdom: MMCM / MCM-H

Belgium & the Netherlands: rMCM

United States: Knifefish AUV (LCS MCM)

Across these navies, the pattern is consistent: MCM is where AUVs moved from experimentation to doctrine and operational deployment. Unlike other missions, MCM has not simply added autonomy, it has redefined how the mission itself is conducted.

By contrast, Anti-Submarine Warfare (ASW) has seen limited market disruption. Mature sensing architectures, towed arrays, sonobuoys, and decoy fields, remain highly effective, positioning AUVs mainly in complementary roles rather than as market drivers.

That said, miniaturization and new sensor concepts will disrupt ASW in the near future.

In civil and industrial domains, AUV adoption is primarily driven by imaging missions, with side-scan sonar and optical cameras dominating. CTD remains the default physico-chemical payload, while more specialized sensors address narrower, mission-specific needs.

Looking ahead

This snapshot does not prefigure the changes already underway. Miniaturization, cost reduction, and a broader shift toward robotics are set to reshape the AUV market.

In defense, near-term evolution is likely to be driven by asymmetric threats and distributed concepts such as AUV swarms, where cost, numbers, and deployability matter as much as individual platform performance.

In civil and scientific domains, lower costs and simpler operations should accelerate the replacement of towed systems and enable denser water-column sampling, complementing floats and gliders with AUV-based observations.

👉 Link : https://www.linkedin.com/posts/vidal-teixeira-672a27b2_underwatersystems-auv-mcm-activity-7411717569323347968-7hVq?utm_source=share&utm_medium=member_desktop&rcm=ACoAADgbq5IBdJEba6NSrWg-B7x4okZyTK9q-DQ